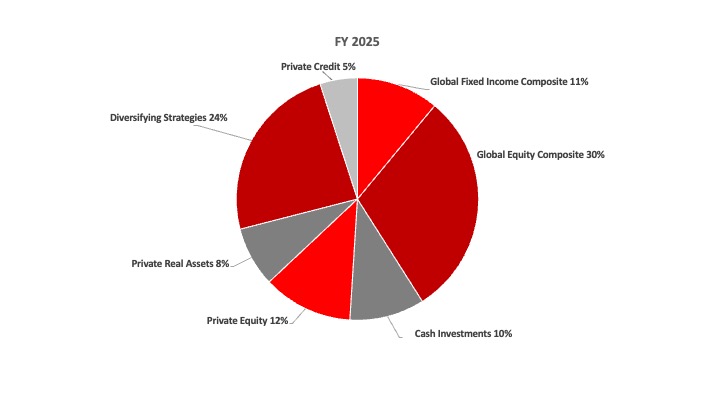

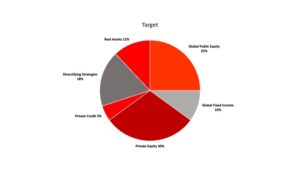

ENDOWMENT POOL ASSET ALLOCATION

Meeting the University of Utah's current and future needs

In recent years the University has been working with our consultants to further diversify the Endowment Pool. In 2015 the portfolio was approximately two-thirds public markets exposure. Since then we’ve worked to increase alternative investment exposure to achieve meaningful diversification, manage risk and improve long-term performance. Today the target asset allocation is about 40% public markets and 60% alternatives. The most significant change is an increase in private capital, targeted at 47%. Building out the portfolio to achieve these aims will take several years and proceed at a deliberate pace with careful consideration to manager selection and portfolio construction.